On Tuesday, the Bank of Japan (BOJ) halted eight years of negative interest rates and other aspects of its unconventional policy, marking a historic departure from its previous goal of using decades of huge monetary stimulus to reflate GDP.

Although it was Japan’s first interest rate increase in 17 years, economists note that the move essentially maintains rates unchanged as the central bank is forced to gradually raise borrowing costs due to a shaky economic recovery.

With this change, Japan becomes the final central bank to remove negative interest rates, bringing an end to a period in which governments attempted to boost economy via unconventional monetary policies and cheap money on a global scale.

According to HSBC’s head Asia economist Frederic Neumann, “the BOJ today took its first, tentative step towards policy normalisation.” Neumann is based in Hong Kong.

“The elimination of negative interest rates in particular signals the BOJ’s confidence that Japan has emerged from the grip of deflation.”

The BOJ abandoned a policy that had been in effect since 2016 and levied a 0.1% fee on some excess reserves that financial institutions kept on deposit with the central bank, in a move that was widely anticipated.

The BOJ chose to guide the overnight call rate in a band of 0-0.1% and set it as its new policy rate. It did this in part by giving deposits at the central bank an interest rate of 0.1%.

The yield curve control (YCC) policy, which had been in effect since 2016 and capped long-term interest rates at zero, was also abandoned by the central bank.

However, the BOJ said in a statement announcing the decision that it will continue to buy “broadly the same amount” of government bonds as previously and increase purchases if yields rise quickly.

In addition, the BOJ decided to stop buying riskier assets such Japanese real estate investment trusts and exchange-traded funds (ETFs).

READ ALSO: Ukraine’s army chief believes that using drones will give them an advantage over Russia

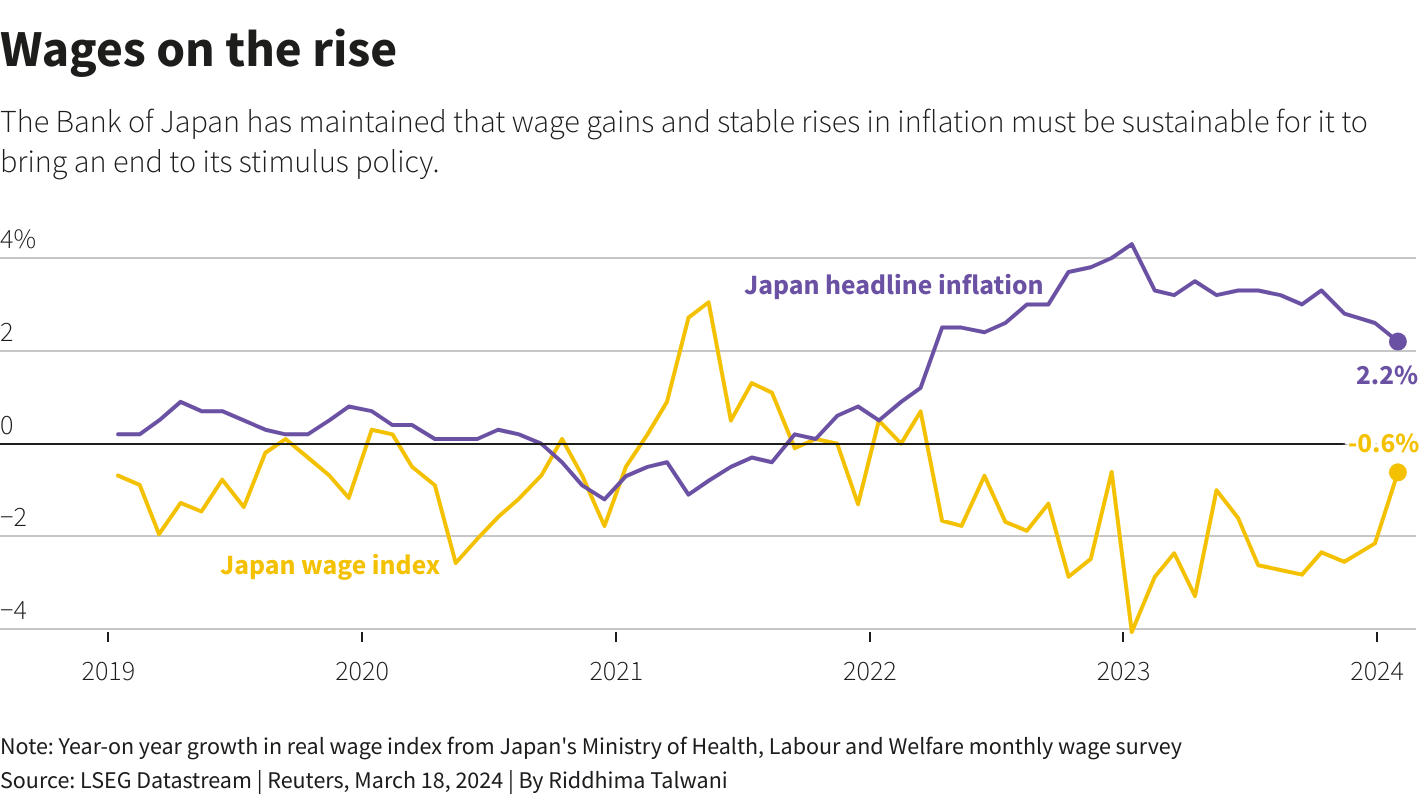

In an official statement, the central bank explained why it had decided to pull the enormous stimulus program of former Governor Haruhiko Kuroda. “We judged that sustainable, stable achievement of our price target came in sight,” officials stated.

Since inflation has been higher than the BOJ’s target of 2% for more than a year, many market participants had predicted that negative interest rates will stop in March or April.

As an indication that any rate increase in the future will be gradual, the BOJ stated in the statement that it anticipates “accommodative financial conditions will be maintained for the time being.”

The wording contrasted with the more cautious guidance that was cut from the statement, when the Bank of Japan promised to increase stimulus when necessary and to continue printing money at a faster rate until inflation consistently rose beyond 2%.

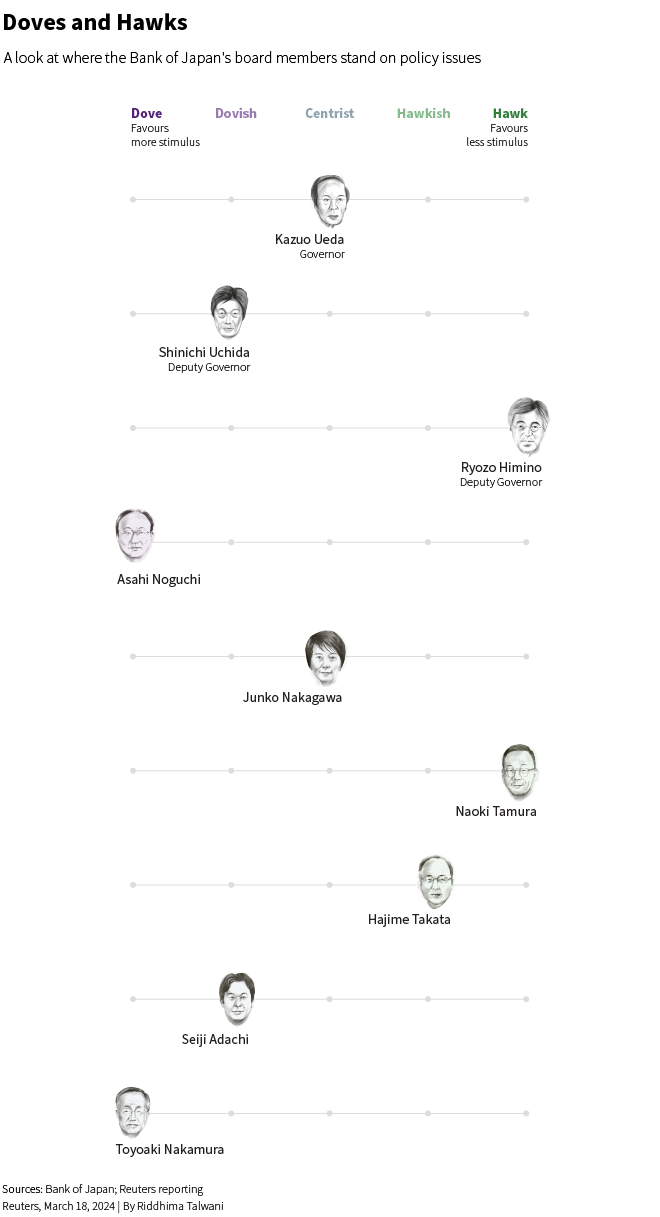

Tuesday saw a lot of volatility in Japanese stocks. As investors interpreted the BOJ’s dovish advice as an indication that the interest rate gap between Japan and the US would probably not widen considerably, the value of the yen dropped to about 150 per dollar.

Now, investors are watching Governor Kazuo Ueda’s news conference following the meeting for hints about when more rate increases might occur.

High stakes are involved. An increase in bond yields would make it more expensive to finance Japan’s massive public debt, which is the highest among developed nations at twice the size of its GDP.

The world’s financial markets could be shocked if the last source of cheap cash disappears, as Japanese investors who have accumulated assets abroad in quest of higher returns may decide to repatriate their holdings.

The BOJ started a massive asset-buying program in 2013 under former Governor Kuroda with the initial goal of driving inflation to a target of 2% in around two years.

In 2016, the central bank changed its stimulus program to one that was more sustainable due to poor inflation, which prompted the introduction of negative rates and YCC.

However, the BOJ changed YCC last year to loosen its hold on long-term rates as the significant declines in the value of the yen increased the cost of imports and increased public criticism of the drawbacks of Japan’s extremely low interest rates.

Contributed by Leika Kihara. Sam Holmes did the editing.